Monarch Tavern

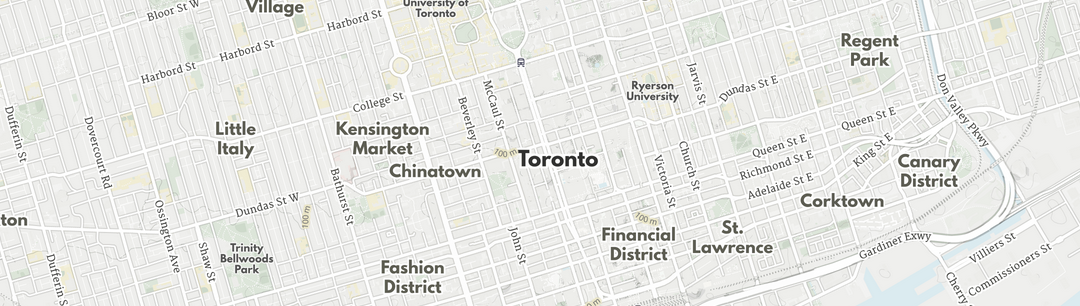

The Monarch Tavern is a long time fixture on Clinton street in Little Italy. With recently revamped food and drink offerings, the Monarch now serves up 15 craft beers on tap including conditioned cask and over 35 bourbons. The large space is spread out over two floors and includes pub games like pool, pinball and darts.